What is the Circle Rate?

The circle rate in Delhi is the minimum value set by the Delhi Revenue Department at which a property, such as a flat in Delhi, a plot, or commercial space, can be registered with the government. It serves as a benchmark for property valuation during sale, transfer or purchase. As well as with this, it ensures transparency in transactions and prevents undervaluation that could lead to tax evasion. These rates are critical for calculating stamp duty and registration charges. These are essential components of property transactions.

With that, Circle rates vary significantly based on different factors like location category, property type, construction quality, and the age of the building. Let's take an example that a property in a posh area in Delhi, like South Delhi, will have a higher circle rate compared to less developed areas. This entirely reflects the market dynamics of the region

How does Circle Rate in Delhi differ from the Market Rate?

In Delhi, circle rates and market rates play distinct roles in property transactions. Therefore, understanding their differences is essential for moving through the real estate market effectively. Let's have a look at the table given below to understand it more:

| Aspect |

Circle Rate |

Market Rate |

| Property Registration |

Used as the basis for property registration, ensuring standardized legal valuation. |

Reflects the seller's quoted price, based on the property's current market value. |

| Stamp Duty Calculation |

Forms the basis for calculating stamp duty, providing a fixed tax assessment benchmark. |

Does not influence stamp duty; determined by buyer-seller negotiations. |

| Revision Frequency |

Revised sparingly, with updates limited to twice a year for stability. |

Fluctuates frequently based on economic trends, infrastructure, and demand-supply dynamics. |

Difference Between Circle Rate and Stamp Duty Value?

When you are purchasing a property in Delhi, it is very common that you will come across two terms very often. These are the stamp duty value and the circle rate. Consequently, one should know how the two terms differ from one another. Let's see how:

- What They Are: The circle rate is the minimum price set by the government for registering a property. Which depends on things like the property's location. Whether it's a house or a shop and its features.

On the other hand, the stamp duty value is the amount used to calculate the stamp duty fee you pay to the government. When you are buying a property. This value is either the circle rate or the actual price you pay for the property, whichever is higher.

- Their Purpose: The circle rate ensures that properties aren't registered at unfairly low prices, keeping transactions honest. The stamp duty value, however, is used to figure out how much tax (stamp duty) you owe the government to make the property purchase official.

- How They're Set: The government decides the circle rate based on the area, type of property, and local market trends. The stamp duty value, though, comes from comparing the circle rate with the price you agreed to pay for the property, taking the higher of the two as per state rules.

What is Considered When Calculating Stamp Duty Charges?

Stamp duty is a tax paid to the government on purchasing of a property. Moreover, it is one of the significant elements of the buying process of the property in Delhi. Therefore, knowing what goes into calculating this charge can help you budget effectively. Let's briefly explain it:

- Property Value or Circle Rate: The stamp duty is based on either the circle rate or the actual price you pay for the property. Whichever is higher. This is done to ensure the government collects a fair tax.

- Property Location: Which location is the property is situated also plays a big role. As different areas in Delhi have different circle rates. Which directly impacts the stamp duty amount.

- Type of Property: The type of property matters that you are going with also too. For example, residential properties (like homes or apartments) and commercial properties in Delhi (like offices or shops) may have different stamp duty rates.

- State Rules: Stamp duty rates also vary by state. In Delhi, the government sets specific rates. Which can also depend on factors like the buyer's gender (for eg, women may get a small discount) or the property's age.

What is the Current Circle Rate in Delhi 2025?

Talking about current circle rates in Delhi 2025, a committee led by the Divisional Commissioner is revising these rates. In order to make it align with the current market conditions, with a report which is expected soon.

But currently, the rates are categorized from A to H: So, for Category A (e.g., Vasant Vihar) is ₹7,74,000 per sqm. While Category H (e.g., Nand Nagri) is ₹23,280 per sqm. With that, a 20% reduction, extended until December 31, 2025. Which lowers these to ₹6,19,200 and ₹18,624 per sqm, respectively. Along with this, for Commercial properties in Delhi have higher rates and agricultural land ranges from ₹2.25–5 crore per acre. Also, you can check the Delhi Revenue Department's website for the current revised updates.

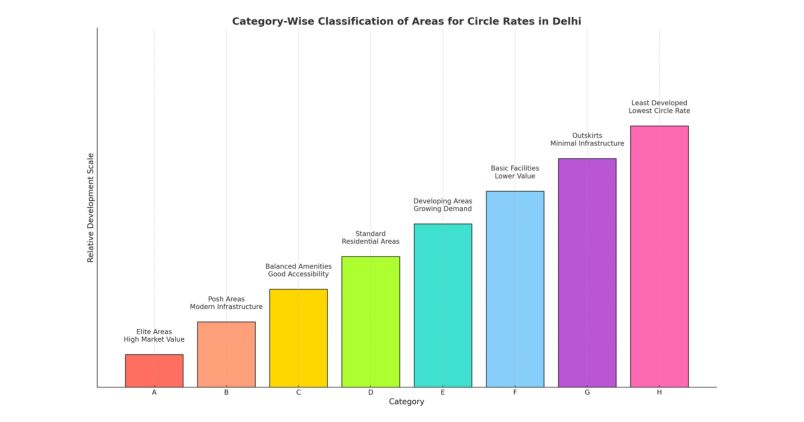

Category-Wise Classification of Areas for Circle Rates in Delhi

Delhi's localities are categorized from A to H to determine property circle rates. Which reflects their market value, facilities and infrastructure. Let's look at the table given below that outlines this classification.

| Categories |

Localities |

Key Characteristics |

| A |

Vasant Vihar, Jor Bagh, Golf Links, Shanti Niketan, Maharani Bagh, Sunder Nagar, New Friends Colony, Anand Niketan, Panchshila Park |

Elite areas with premium facilities, high market value, and prime locations |

| B |

Greater Kailash (I, II, III, IV), Hauz Khas, Defence Colony, Green Park, Safdarjung Enclave, Neeti Bagh, Sarvodaya Enclave |

Considered as a posh area with modern infrastructure, good connectivity |

| C |

Kalkaji, Malviya Nagar, Saket, Civil Lines, Lajpat Nagar (I, II, III, IV), Vasant Kunj, Alaknanda, Nizamuddin West |

Balanced amenities, moderate market value, and good accessibility |

| D |

Dwarka, Janakpuri, Rajouri Garden, Mayur Vihar, Karol Bagh, Indraprastha Extension, Jangpura Extension, Daryaganj |

Standard residential areas with moderate demand |

| E |

Rohini, Uttam Nagar, Moti Nagar, Kashmere Gate, Pandav Nagar, Mahavir Nagar, Chandni Chowk, Pahar Ganj |

Functional infrastructure, growing real estate markets |

| F |

Dilshad Garden, Hari Nagar, Govindpuri, Uttam Nagar Extension, Madhu Vihar, Nand Nagri, Zakir Nagar, Mukherjee Park Extension |

Developing areas with basic facilities, lower market value |

| G |

Jahangirpuri, Dabri Extension, Vivek Vihar Phase I, Ambedkar Nagar, East Delhi, Dakshinpuri, Tagore Garden Extension |

Outskirts areas in Delhi with minimal infrastructure, low demand |

| H |

Sultanpur Majra, Seelampur, parts of North-East Delhi |

Least developed areas with basic facilities have the lowest circle rates |

Delhi Circle Rate for Flats in 2025

The circle rate in Delhi for flats varies depending on the type and size of the property. As well as whether it is a DDA, society or private builder flat.The following table highlights the circle rates in Delhi for flats.

| Area |

DDA, Society Flats (per sq metre) |

Private Builder Flats (per sq metre) |

Multiplying Factors for Private Colonies |

| Up to 30 sqm |

Rs 50,400 |

Rs 55,400 |

1.1 |

| 30-50 sqm |

Rs 54,480 |

Rs 62,652 |

1.15 |

| 50-100 sqm |

Rs 66,240 |

Rs 79,488 |

1.2 |

| Over 100 sqm |

Rs 76,200 |

Rs 95,250 |

1.25 |

| Multi-storey apartment |

Rs 87,840 |

Rs 1,10,000 |

1.25 |

Note: One square metre is 10.76 square feet. Which means circle rates per square foot can be calculated by dividing the per square metre rate by 10.76.

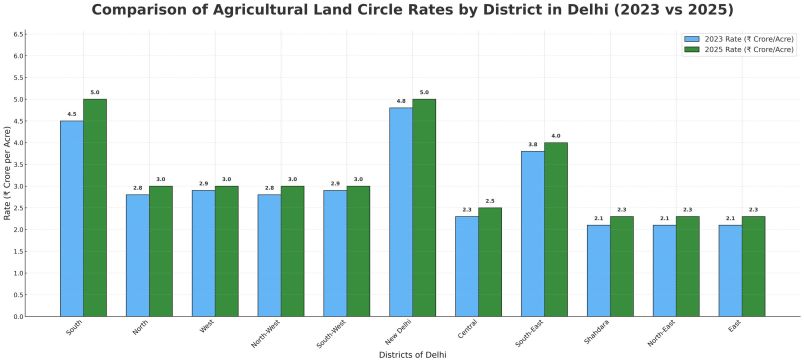

Delhi Circle Rate for Agricultural Land 2025

The circle rates for agricultural land in Delhi effective as of 2025 vary by district and village type. The table gives below also includes the maximum permissible ground coverage (MPGC) for agricultural land use. Let's have a look at it:

| District |

Green Belt Villages (₹ Crore/Acre) |

Urbanised Villages (₹ Crore/Acre) |

Rural Villages (₹ Crore/Acre) |

MPGC (%) |

| South |

5.0 |

5.0 |

5.0 |

10 |

| North |

3.0 |

3.0 |

3.0 |

12 |

| West |

3.0 |

3.0 |

3.0 |

12 |

| North-west |

3.0 |

3.0 |

3.0 |

12 |

| South-west |

3.0 |

4.0 |

3.0 |

11 |

| New Delhi |

5.0 |

5.0 |

5.0 |

10 |

| Central |

- |

2.5 |

2.5 |

15 |

| South-east |

- |

4.0 |

2.5 |

13 |

| Shahdara |

2.3 |

2.3 |

2.3 |

14 |

| North-east |

- |

2.3 |

2.3 |

14 |

| East |

- |

2.3 |

- |

14 |

Note: The Delhi government can change these rates with a certain frequency and may differ with definite land use policies.

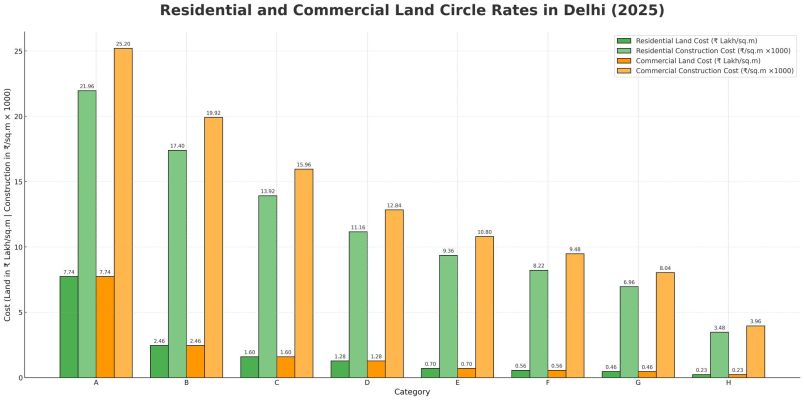

Residential and Commercial Land Circle Rates in Delhi 2025

For Residential Land

The Circle Rates for residential land in Delhi as of 2025 are categorized based on the basis of property types and include the Floor Area Ratio (FAR). Which provides a unique perspective. Let's have a look at it:

| Category |

Land Cost (₹ Lakh/Sq Mtr) |

Construction Cost (₹/Sq Mtr) |

FAR (%) |

| A |

7.74 |

21,960 |

350 |

| B |

2.46 |

17,400 |

300 |

| C |

1.60 |

13,920 |

250 |

| D |

1.28 |

11,160 |

225 |

| E |

0.70 |

9,360 |

200 |

| F |

0.56 |

8,220 |

175 |

| G |

0.46 |

6,960 |

150 |

| H |

0.23 |

3,480 |

125 |

Note: These rates will be updated periodically by the Delhi government and might affect the property registration and taxation.

For Commercial Land

The rates for commercial land in Delhi as of 2025 are categorized by property type and the permissible commercial usage (%) to give a distinct perspective. Let's have a look at the table:

| Category |

Land Cost (₹ Lakh/Sq Mtr) |

Construction Cost (₹/Sq Mtr) |

Commercial Usage (%) |

| A |

7.74 |

25,200 |

80 |

| B |

2.46 |

19,920 |

75 |

| C |

1.60 |

15,960 |

70 |

| D |

1.28 |

12,840 |

65 |

| E |

0.70 |

10,800 |

60 |

| F |

0.56 |

9,480 |

55 |

| G |

0.46 |

8,040 |

50 |

| H |

0.23 |

3,960 |

45 |

Note: These rates are updated by the Delhi government every now and then and they can affect the registration and taxation of commercial property as well.

Delhi Circle Rate of Land in Colonies in 2025

Below are mentioned Circle rates for land in Delhi's colonies for the year 2025. Let's have a look at the time given below:

| Area |

Land Cost per sqm |

Construction Cost |

| Lodi Road Industrial Area |

Rs 7.74 lakh |

Rs 21,960 |

| Maharani Bagh |

Rs 7.74 lakh |

Rs 21,960 |

| Nehru Place |

Rs 7.74 lakh |

Rs 21,960 |

| New Friends Colony |

Rs 7.74 lakh |

Rs 21,960 |

| Panchshila Park |

Rs 7.74 lakh |

Rs 21,960 |

| Rajendra Place |

Rs 7.74 lakh |

Rs 21,960 |

| Shanti Niketan |

Rs 7.74 lakh |

Rs 21,960 |

| Sunder Nagar |

Rs 7.74 lakh |

Rs 21,960 |

| Vasant Vihar |

Rs 7.74 lakh |

Rs 21,960 |

| Anand Niketan |

Rs 7.74 lakh |

Rs 21,960 |

| Basant Lok DDA Complex |

Rs 7.74 lakh |

Rs 21,960 |

| Bhikaji Cama Place |

Rs 7.74 lakh |

Rs 21,960 |

| Friends Colony |

Rs 7.74 lakh |

Rs 21,960 |

| Friends Colony East |

Rs 7.74 lakh |

Rs 21,960 |

| Friends Colony West |

Rs 7.74 lakh |

Rs 21,960 |

| Golf Links |

Rs 7.74 lakh |

Rs 21,960 |

| Kalindi Colony |

Rs 7.74 lakh |

Rs 21,960 |

| Anand Lok |

Rs 2.46 lakh |

Rs 17,400 |

| Andrews Ganj |

Rs 2.46 lakh |

Rs 17,400 |

| Defence Colony |

Rs 2.46 lakh |

Rs 17,400 |

| Greater Kailash I |

Rs 2.46 lakh |

Rs 17,400 |

| Greater Kailash II |

Rs 2.46 lakh |

Rs 17,400 |

| Greater Kailash III |

Rs 2.46 lakh |

Rs 17,400 |

| Greater Kailash IV |

Rs 2.46 lakh |

Rs 17,400 |

| Green Park |

Rs 2.46 lakh |

Rs 17,400 |

| Gulmohar Park |

Rs 2.46 lakh |

Rs 17,400 |

| Hamdard Nagar |

Rs 2.46 lakh |

Rs 17,400 |

| Hauz Khas |

Rs 2.46 lakh |

Rs 17,400 |

| Maurice Nagar |

Rs 2.46 lakh |

Rs 17,400 |

| Munirka Vihar |

Rs 2.46 lakh |

Rs 17,400 |

| Neeti Bagh |

Rs 2.46 lakh |

Rs 17,400 |

| Nehru Enclave |

Rs 2.46 lakh |

Rs 17,400 |

| Nizamuddin East |

Rs 2.46 lakh |

Rs 17,400 |

| Pamposh Enclave |

Rs 2.46 lakh |

Rs 17,400 |

| Panchsheel Park |

Rs 2.46 lakh |

Rs 17,400 |

| Safdarjang Enclave |

Rs 2.46 lakh |

Rs 17,400 |

| Sarvapriya Vihar |

Rs 2.46 lakh |

Rs 17,400 |

| Sarvodaya Enclave |

Rs 2.46 lakh |

Rs 17,400 |

| Civil Lines |

Rs 1.60 lakh |

Rs 13,920 |

| East of Kailash |

Rs 1.60 lakh |

Rs 13,920 |

| East Patel Nagar |

Rs 1.60 lakh |

Rs 13,920 |

| Jhandewalan Area |

Rs 1.60 lakh |

Rs 13,920 |

| Kailash Hill |

Rs 1.60 lakh |

Rs 13,920 |

| Kalkaji |

Rs 1.60 lakh |

Rs 13,920 |

| Lajpat Nagar I |

Rs 1.60 lakh |

Rs 13,920 |

| Lajpat Nagar II |

Rs 1.60 lakh |

Rs 13,920 |

| Lajpat Nagar III |

Rs 1.60 lakh |

Rs 13,920 |

| Lajpat Nagar IV |

Rs 1.60 lakh |

Rs 13,920 |

| Malviya Nagar |

Rs 1.60 lakh |

Rs 13,920 |

| Masjid Moth |

Rs 1.60 lakh |

Rs 13,920 |

| Munirka |

Rs 1.60 lakh |

Rs 13,920 |

| Nizamuddin West |

Rs 1.60 lakh |

Rs 13,920 |

| Panchsheel Extension |

Rs 1.60 lakh |

Rs 13,920 |

| Punjabi Bagh |

Rs 1.60 lakh |

Rs 13,920 |

| Som Vihar |

Rs 1.60 lakh |

Rs 13,920 |

| Vasant Kunj |

Rs 1.60 lakh |

Rs 13,920 |

| Alaknanda |

Rs 1.60 lakh |

Rs 13,920 |

| Chittaranjan Park |

Rs 1.60 lakh |

Rs 13,920 |

| New Rajinder Nagar |

Rs 1.28 lakh |

Rs 11,160 |

| Old Rajinder Nagar |

Rs 1.28 lakh |

Rs 11,160 |

| Rajouri Garden |

Rs 1.28 lakh |

Rs 11,160 |

| Anand Vihar |

Rs 1.28 lakh |

Rs 11,160 |

| Daryaganj |

Rs 1.28 lakh |

Rs 11,160 |

| Dwarka |

Rs 1.28 lakh |

Rs 11,160 |

| East End Apartments |

Rs 1.28 lakh |

Rs 11,160 |

| Gagan Vihar |

Rs 1.28 lakh |

Rs 11,160 |

| Hudson Line |

Rs 1.28 lakh |

Rs 11,160 |

| Indraprastha Extension |

Rs 1.28 lakh |

Rs 11,160 |

| Janakpuri |

Rs 1.28 lakh |

Rs 11,160 |

| Jangpura A |

Rs 1.28 lakh |

Rs 11,160 |

| Jangpura Extension |

Rs 1.28 lakh |

Rs 11,160 |

| Jasola Vihar |

Rs 1.28 lakh |

Rs 11,160 |

| Karol Bagh |

Rs 1.28 lakh |

Rs 11,160 |

| Kirti Nagar |

Rs 1.28 lakh |

Rs 11,160 |

| Mayur Vihar |

Rs 1.28 lakh |

Rs 11,160 |

| Chandni Chowk |

Rs 70,080 |

Rs 9,360 |

| East End Enclave |

Rs 70,080 |

Rs 9,360 |

| Gagan Vihar Extension |

Rs 70,080 |

Rs 9,360 |

| Hauz Qazi |

Rs 70,080 |

Rs 9,360 |

| Jama Masjid |

Rs 70,080 |

Rs 9,360 |

| Kashmere Gate |

Rs 70,080 |

Rs 9,360 |

| Khirki Extension |

Rs 70,080 |

Rs 9,360 |

| Madhuban Enclave |

Rs 70,080 |

Rs 9,360 |

| Mahavir Nagar |

Rs 70,080 |

Rs 9,360 |

| Moti Nagar |

Rs 70,080 |

Rs 9,360 |

| Pahar Ganj |

Rs 70,080 |

Rs 9,360 |

| Pandav Nagar |

Rs 70,080 |

Rs 9,360 |

| Rohini |

Rs 70,080 |

Rs 9,360 |

| Sarai Rihilla |

Rs 70,080 |

Rs 9,360 |

| Zakir Nagar Okhla |

Rs 56,640 |

Rs 8,220 |

| Anand Parbat |

Rs 56,640 |

Rs 8,220 |

| Arjun Nagar |

Rs 56,640 |

Rs 8,220 |

| Daya Basti |

Rs 56,640 |

Rs 8,220 |

| Dilshad Colony |

Rs 56,640 |

Rs 8,220 |

| Dishad Garden |

Rs 56,640 |

Rs 8,220 |

| BR Amdedkar Colony |

Rs 56,640 |

Rs 8,220 |

| Ganesh Nagar |

Rs 56,640 |

Rs 8,220 |

| Govindpuri |

Rs 56,640 |

Rs 8,220 |

| Hari Nagar |

Rs 56,640 |

Rs 8,220 |

| Jangpura B |

Rs 56,640 |

Rs 8,220 |

| Madhu Vihar |

Rs 56,640 |

Rs 8,220 |

| Majnu Ka Tila |

Rs 56,640 |

Rs 8,220 |

| Mukheree Park Extension |

Rs 56,640 |

Rs 8,220 |

| Nand Nagri |

Rs 56,640 |

Rs 8,220 |

| Uttam Nagar |

Rs 56,640 |

Rs 8,220 |

| Ambedkar Nagar Jahangirpuri |

Rs 46,200 |

Rs 6,960 |

| Amdedkar Nagar East Delhi |

Rs 46,200 |

Rs 6,960 |

| Amber Vihar |

Rs 46,200 |

Rs 6,960 |

| Dabri Extension |

Rs 46,200 |

Rs 6,960 |

| Dakshinpuri |

Rs 46,200 |

Rs 6,960 |

| Dashrath Puri |

Rs 46,200 |

Rs 6,960 |

| Hari Nagar Extension |

Rs 46,200 |

Rs 6,960 |

| Vivek Vihar Phase I |

Rs 46,200 |

Rs 6,960 |

| Tagore Garden |

Rs 46,200 |

Rs 6,960 |

| Sultanpur Majra |

Rs 23,280 |

Rs 3,480 |

Note: These rates are indicative and may be revised periodically by the Delhi government.

What is the Circle Rate in Delhi for Plots?

Residential plots in Delhi as of 2025 are categorized from A to H by the New Delhi Municipal Corporation (NDMC). This reflects various property valuations across the city. Below is the circle rate for all residential plot categories in Delhi. Let's have a look at the table given below:

| Category |

Minimum Land Valuation (per sqm) |

Construction Cost (per sqm) |

Typical Localities (Examples) |

Approx. Rental Yield (%) |

| A |

₹7,74,000 |

₹21,960 |

Vasant Vihar, Chanakyapuri |

2.5 - 3.0 |

| B |

₹2,46,000 |

₹17,400 |

Defence Colony, Greater Kailash |

2.8 - 3.2 |

| C |

₹1,60,000 |

₹13,920 |

East of Kailash, Green Park |

3.0 - 3.5 |

| D |

₹1,28,000 |

₹11,160 |

Rajouri Garden, Dwarka |

3.2 - 3.8 |

| E |

₹70,080 |

₹9,360 |

Rohini, Pandav Nagar |

3.5 - 4.2 |

| F |

₹56,640 |

₹8,220 |

Govindpuri, Uttam Nagar |

4.0 - 5.0 |

| G |

₹46,200 |

₹6,960 |

Sultanpur Majra, Tagore Garden |

4.5 - 5.5 |

| H |

₹23,280 |

₹3,480 |

Rural/Peripheral Colonies |

5.0 - 6.0 |

Note: The Delhi government periodically revises such rates and these rates affect property registration and taxation.

Factors Affecting Circle Rate in Delhi

The circle rate in Delhi is influenced by several key factors. These factors determine the pricing structure across different regions and help categorize areas into eight groups. From premium Category A to more affordable Category H. Below are the primary factors that impact circle rates in Delhi:

Property Market Value

- The market value of a property significantly influences its circle rate. The government assesses the current market trends and demand for real estate in a specific area to determine the circle rate.

- Typically, the market value of a property is usually higher than its circle rate. Which reflects the dynamic nature of Delhi's real estate market.

Property Usage

- The purpose for which a property is used plays a significant role in determining its circle rate. As Properties designated for commercial activities such as offices or retail spaces attract higher circle rates.

- When compared to residential properties because these properties have the potential for generating higher revenue.

Available Facilities and Infrastructure

- The presence of modern facilities and infrastructure also significantly increases a property's circle rate.

- For eg, if the property has the following features such as gated communities, 24/7 security, recreational facilities like gyms or swimming pools and green parks. That will eventually contribute to higher valuations. Plus, Properties with superior facilities are often placed in higher categories, such as A or B.

Location and Neighborhood

- The geographical location of a property is a critical factor that affects its circle rate. For eg, if properties are considered to be posh or have well-connected neighborhoods. Such as those in South Delhi or Central Delhi, like Karol Bagh, will have higher circle rates due to their desirability and accessibility.

- Compared to the properties in less developed areas in Delhi fall into lower categories such as G or H.

Type and Quality of Construction

- The nature of the property's construction also affects its circle rate. Because if the properties are developed by private builders. Which has features like it has modern designs and premium materials.

- Then, typically, it has higher circle rates than government-constructed properties such as those under the Delhi Development Authority (DDA). The quality and age of construction further influence the valuation.

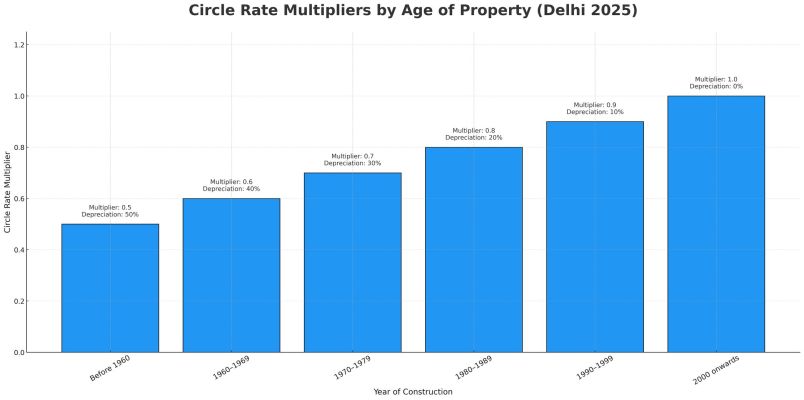

Circle Rates According to the Age of Properties

In Delhi, the age of a property becomes the determinant of the multiplier applied on the construction part of the value of the property to calculate the circle rate. This is the age factor that lowers the effective cost in the case of old buildings. Let's take a look at the table:

| Year of Construction |

Age Factor (Multiplier) |

Depreciation Logic |

| Before 1960 |

0.5 |

50% value retained due to extensive aging |

| 1960–1969 |

0.6 |

40% depreciation |

| 1970–1979 |

0.7 |

30% depreciation |

| 1980–1989 |

0.8 |

20% depreciation |

| 1990–1999 |

0.9 |

10% depreciation |

| 2000 onwards |

1 |

No depreciation assumed |

- New properties (built in 2000 or later) are valued with no depreciation, i.e, value drop (factor of 1.0).

- Older buildings have their construction value reduced by 10% to 50%. Which, depending on age that reflects wear and less modern facilities in it.

How to Apply the Age Factor?

- For independent houses in Delhi: Multiply the built-up area by the minimum construction cost and then by the relevant age factor.

- For plots: The age factor is typically not applied, since bare land does not depreciate; only constructed properties do.

- For flats or builder floors: For calculating the age factor in Delhi, calculate using built-up area × construction cost × age factor.

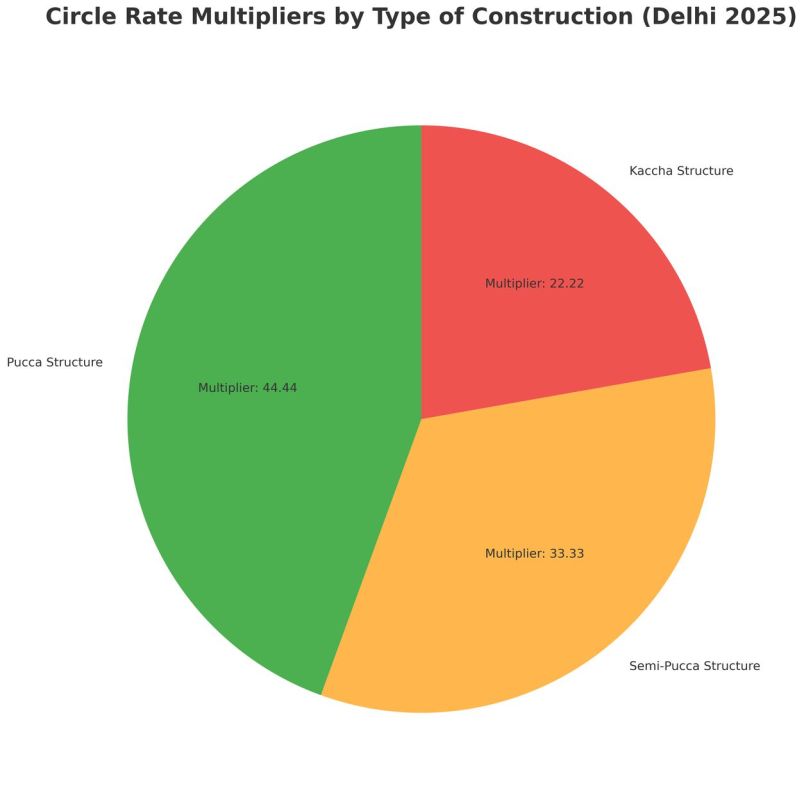

What are the Different Multiplying Factors for Calculating the Circle Rate in Delhi?

Delhi's 2025 circle rates adjust via multiplying factors for pucca, semi-pucca and kaccha properties, factoring in maintenance costs for fair valuation and long-term investment insights. See table for more details.

| Type |

Meaning |

Circle Rate Multiplier |

Maintenance Cost Impact (₹/Sq Mtr/Year) |

| Pucca structures |

Fully built with durable materials like bricks and cement |

1.0 |

1,500 |

| Semi-pucca structures |

Partially built with durable materials, not fully finished |

0.75 |

1,000 |

| Kaccha structures |

Built with less durable materials like mud or thatch |

0.5 |

500 |

Note: These multipliers and estimates of maintenance cost are periodically revised by the government of Delhi and that may affect property valuation and tax.

How to Check the Circle Rate in Delhi in 2025?

Circle rates in Delhi for 2025 can be checked through the following methods for accurate, area-specific property valuations. Let's have a look at it:

1. Official Government Portals

- Visit the Delhi Revenue Department's website, i.e, Delhi Online Registration Information System (DORIS) at eval.delhigovt.nic.in. Here you'll find the latest, area-wise circle rate lists, categorized for easy reference.

- Select your district, sub-division, and precise locality to access the current rates relevant to your property.

2. Category Identification

- Figure out the type of your property (A-H), and identify its type (residential, commercial, agricultural).

- Circle rates vary not just by area, but also by category and property usage, so precise identification is essential.

3. Private and Real Estate Portals

- Leading property sites, realestateindia.com, have mirror government data and offer user-friendly interfaces, calculators, and guides to confirm current rates.

How to Calculate the Circle Rate of Property in Delhi?

| Property Type |

How to Calculate? |

| Independent Plot |

Area (in sqm) × Circle Rate (per sqm for locality) |

| Flat / DDA / Society Flat |

Built-up Area (sqm) × Minimum Construction Cost × Age Factor |

| Multi-storey Flat |

Built-up Area (sqm) × Relevant Flat Circle Rate (per sqm) |

| House on Plot |

(Plot Area × Circle Rate) + (Built-up Area × Minimum Construction Cost × Age Factor) |

| Commercial Plot |

Area (in sqm) × Commercial Circle Rate (per sqm for the specific commercial category/locality) |

| Industrial Property |

Area (in sqm) × Industrial Circle Rate (per sqm for the designated industrial zone/locality) |

| Builder Floor |

Built-up Area (sqm) × Minimum Construction Cost × Age Factor (often similar to society/standalone flats) |

| Shop/Showroom (in Complex/Mall) |

Built-up/Carpet Area (sqm) × Commercial Circle Rate (per sqm)—sometimes a premium multiplier may apply |

| Agricultural Land |

Area (in sqm or acre) × Agricultural Land Circle Rate (as notified by the Revenue Department) |

| Mixed-Use Property |

Calculate each relevant component area (residential, commercial), apply respective rates, and sum the totals |

Let's see with these examples:

- A 100 sqm plot in Category C (₹1,60,000/sqm): Value = 100 × 1,60,000 = ₹1,60,00,000.

- For a 100 sqm house built in 1995, use the age factor (0.9), then: Construction Value = 100 × construction cost × 0.9.

Online Circle Rate Calculators

- Both the Delhi government portal and private real estate websites host free calculators.

- So, you just have to enter your locality, property type, area (in sqm) and year of construction (to account for age factor).

- The calculator instantly shows the minimum property value as per the circle rate and the construction cost, streamlining the process and reducing manual errors.

How to Evaluate a Property Using Circle Rate in Delhi?

Evaluating a property using circle rates in Delhi for 2025 helps determine its minimum value for buying, selling, or taxation. This step-by-step guide simplifies the process with a unique focus on practical tips, such as factoring in facilities like parking or lifts. Step-by-Step Process to Evaluate a Property Using Circle Rate:

1. Find the Circle Rate for Your Area

- Firstly, you have to check the official circle rate for your locality and property type (residential, commercial or agricultural) using the Delhi Online Registration Information System (DORIS) at eval.delhigovt.nic.in or by visiting your local SRO.

- For example, Category A areas like Vasant Vihar have a rate of ₹7.74 lakh/sq mtr, while Category H areas like Sultanpur Majra are ₹23,280/sq mtr. There is a tip to use the DORIS mobile app for quick access, even offline, to ensure you have the latest 2025 rates.

2. Accurately Measure Area

- Measure the property in square meters. For plots in Delhi, use the total land area. For flats or houses, use the built-up area (including walls and common spaces). Accurate measurements are key to avoiding errors in valuation.

- There is a small tip that hire a professional surveyor for precise measurements, especially for irregularly shaped plots, to prevent disputes during registration.

3. Apply the Relevant Formula for Circle Rate

- Circle rates in Delhi vary by different property types, be it plots, builder floors, apartments, flats, or even PGs. For this, use these formulas to calculate: Plots (area × circle rate); Builder Floors/Flats/Apartments (built-up area × circle rate × age multiplier).

- For accurate amenities like parking (adds ₹3 lakh) or lifts (adds 10% to value). For a more accurate estimate, don't forget to include facilities like parking (adds ₹3 lakh) or lifts (adds 10% to the value).

4. Adjust for Age Factor

- Older properties lose value due to wear and tear, so apply an age multiplier to the construction cost. For eg, A 1975 flat's construction cost is reduced by 30% (multiplier 0.7).

- But with that, it is important to check property documents for the exact construction year to apply the correct multiplier, as this significantly impacts valuation.

5. Compare with Market Rate

- Stamp duty is calculated on the higher of the circle rate value or the market rate (actual sale price).

- For instance, if a Category D property's circle rate value is ₹1.28 crore but the market price is ₹1.5 crore, stamp duty (4% for women, 6% for men) applies to ₹1.5 crore. But also, research recent sales in your area via realestateindia.com to estimate market rates accurately.

6. Confirm Latest Rates with the SRO

- The circle rates can alter at any time. To prevent the complications of legal matters or paying too much stamp duty.

- This is why always confirm the rates of the year in which the transaction is going to take place with your local SRO.

How does the SRO Office know the Circle Rate in Delhi?

1. Official Updates

- The SRO is directly informed about the regular notifications of the Delhi Revenue Department. The official lists are available both in print and on soft copies in the SRO. So, as to make sure that all the officials will be given the same information in real-time during the registration of the property.

2. Verification Process

When registering, the Sub-Registrar Office ( SRO) official:

- Firstly, checks the properties in which the location, area, category, and year of construction are all details will come.

- Then SRO official checks the new official list of circle rates.

- Applies the proper rate, the concerned age factor in case required, and obtains the lower figure.

- Rates and multipliers prevailing at the time of registration are only taken into consideration, and both the buyer and the seller have protection and a clear understanding of the situation.

3. Final Authority

- The official dataset provided by the SRO is going to be the only legal source to be referred to at registration over any of the internet-based services, third-party websites, and the contact details of agents. This approach removes disagreements or inaccuracies of historic or non-official sources.

Circle Rate Disputes and Legal Resolution

The circle rates in Delhi 2025 can lead to an over-estimation of the value of the property, leading to an increase in stamp duty costs. This may be disputable by the buyers at the Sub-Registrar Office (SRO) or District Valuation Committee under Delhi Stamp Rules,2007, with steps given below to file an objection, providing expected resolution timelines:

Procedures to Fight an Objection:

- Making a Written Objection: Send an objection to the SRO at the time of registration and give reasons as to why this circle rate is overrated (i.e., why the market value is low).

- Timeline: SRO responds between 7-10 days.

- Furnish Supporting Documents: Documents to be submitted include, copy of the sale agreement, circle rate sheet, photos of the interior and exterior of the property, and valuation certificate by a government-recognized valuer, previous sale deed of similar properties nearby, application letter describing the case, and identity/address proofs.

- Timeline: Verification requires 10-15 days.

- Committee Review: The District Valuation Committee can raid the property or look through the local transaction information to revalue.

- Timeline: Decision in 30-45 days.

- Recomputation of Stamp Duty: In case it is approved, stamp duty is recalculated so as to pay stamp duty according to the new value, since it saves on expenses.

- Timeline: Adjustment takes place within 5 to 7 days after making the decision.

Have the Circle Rates in Delhi Been Revised?

There is an evaluation of the circle rates in Delhi in 2025, which are the lowest rates fixed by the government on transactions of properties. By July 2025, a committee headed by the Divisional Commissioner will evaluate rates to bring them to match the prevailing rate in the market, which comes in light of discrepancies ever since a major revision happened in 2014. In contrast to the other sources, a proposed 20% reduction of the rates, which was to be continued until December 31, 2025, was to increase the affordability and set off a real estate market.

Note: The latest rates were to be confirmed with Sub-Registrar Office (SRO) or official portals, to be precise.

When Were Delhi Circle Rates Last Revised?

Delhi made the last update of its circle rates in September 2014, and that forms the benchmark of current valuations. It was temporarily lowered by 20 % during the period of the COVID-19 pandemic and eliminated in 2022. In August 2023, agricultural land rates were significantly hiked from ₹53 lakh to ₹2–5 crore per acre. A 2025 revision is planned, with a committee formed in June to finalize updates.

Note: The rates could be locality and property-type-specific and it is best to verify with the official sources.

Revision of Circle Rates in Delhi

| Year |

Details |

Unique Feature (Impact on Buyers) |

| 2014 |

Last major revision, setting rates like ₹7.74 lakh/sq mtr for Category A and ₹23,280/sq mtr for Category H. |

Established baseline for stable valuations. |

| 2021–2022 |

20% rate reduction during COVID-19, later withdrawn. |

Lowered stamp duty, making purchases cheaper temporarily. |

| 2023 |

Agricultural land rates hiked to ₹2–5 crore/acre. |

Increased costs for rural property buyers. |

| 2025 (Proposed) |

Committee formed to revise rates, potentially increasing by 10–15% in prime areas. |

Higher rates may raise loan requirements. |

Note: Future transactions will be affected because proposed revisions need to be approved by the committee.

Latest Updates on Circle Rate in Delhi (June 2025)

In June 2025, Delhi Chief Minister Rekha Gupta announced a committee to revise circle rates, unchanged since 2014 to reflect current market conditions. The panel, led by the Divisional Commissioner, is addressing inconsistencies with a proposed 10–15% hike in prime areas like Vasant Vihar and a 5–10% increase in areas like Dwarka. A unique insight is the focus on streamlining approvals alongside rate revisions, boosting transparency.

Note: To check the latest notifications, visit the Delhi Revenue Department website.

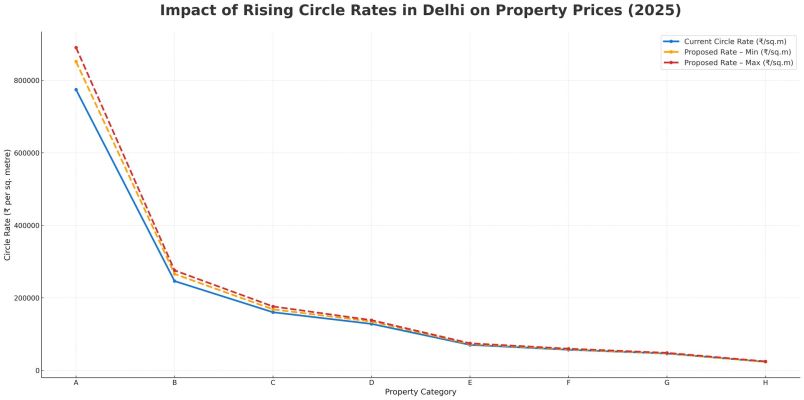

Impact of Rising Circle Rates in Delhi on Property Prices

The escalation of the circle rates in Delhi, which has been proposed for 2025, leads to a direct increment in the cost of property transactions. Increased rates will lead to higher stamp duty (6% charge on men, 4% on women) to add to the cost that people have to pay. An illustration of such a move would be a Category A property at 7.74 lakh/sq mtr, which can incur a 10% surge, i.e., amounting to 77,400/sq mtr. It also restricts the cost of selling below the new rates, further making them not affordable. According to this, although it may hamper sales in peak localities such as Greater Kailash, it may be lower than most other guides.

How Rising Circle Rates in Delhi Affect Property Prices?

| Category |

Example Areas |

Current Rate (₹/sq mtr) |

Proposed Hike (%) |

New Rate Range (₹/sq mtr) |

Impact on Stamp Duty for 100 sqm |

Impact on Property Price and Buyer Implications |

| A |

Vasant Vihar, Jor Bagh |

7,74,000 |

10–15 |

8,51,400 – 8,90,100 |

₹30,960 – ₹46,440 increase |

Significant price rise; higher stamp duty and registration costs increase upfront buyer expenses; may affect loan size needed. |

| B |

Defence Colony, Greater Kailash |

2,46,000 |

8–12 |

2,65,680 – 2,75,520 |

₹19,680 – ₹29,520 increase |

Moderate rise pushes more buyers to budget carefully; market may adjust to increasing costs over time. |

| C |

Kalkaji, East of Kailash |

1,60,000 |

5–10 |

1,68,000 – 1,76,000 |

₹4,800 – ₹9,600 increase |

Noticeable cost increase; buyers may face higher stamp duty but still manageable in mid-range localities. |

| D |

Rajouri Garden, Dwarka |

1,28,000 |

5–8 |

1,34,400 – 1,38,240 |

₹6,400 – ₹10,240 increase |

Slight impact on property pricing; could slow transactions if coupled with market slowdowns. |

| E |

Rohini, Pandav Nagar |

70,080 |

3–6 |

72,182 – 74,284 |

₹2,100 – ₹4,200 increase |

Minor increase; affordable areas face relatively low burden, maintaining appeal for budget buyers. |

| F |

Govindpuri, Uttam Nagar |

56,640 |

2–5 |

57,772 – 59,472 |

₹1,300 – ₹2,800 increase |

Negligible effect on small buyers; still important for transparency and taxation accuracy. |

| G |

Sultanpur Majra, Tagore Garden |

46,200 |

1–4 |

46,662 – 48,048 |

₹460 – ₹1,800 increase |

Minimal price impact; property markets remain stable with small upward shift. |

| H |

Peripheral Colonies |

23,280 |

0–5 |

23,280 – 24,444 |

Up to ₹1,164 increase |

Least affected by hike; however, small increases may cumulatively affect affordability in low-income zones. |

Note: Proposed hikes are subject to committee approval and may vary by area.

Tips to Remember When Calculating Circle Rates in Delhi

The government determines circle rates in Delhi, and this influences the final stamp duty and registration costs, which are the minimum price of registering a property. And here are some brief suggestions on how to do precise calculations for circle rate:

- Check Property Type: Residential property rates: The Navi Mumbai Property rates differ depending on the category: e.g., 21,960/sq.m of Category A flat; commercial property rates: 25,200/sq.m; agricultural property rates. So, first determine the type and then calculate accordingly.

- Locality Category: Delhi has a grouping of eight categories (A-H) according to the Delhi category. The occupants in Category A (e.g., Vasant Vihar) have high rates (7,74,000/sq.m in plots). Whereas Category H (e.g., Sultanpur Majra) is low (23,280/sq.m). Then, for this, check on the site of the Revenue Department.

- Take the factor of Property Age: Use depreciation multipliers (e.g., 1.0 post-2000, 0.5 pre-1960) to adjust rates as per age of property.

- Count Amenities: Houses that are near metro stations or those with modern amenities are charged more. So, this why inquire about the infrastructure and also regarding the facilites.

- Apply Correct Formula: In case of plots, Value = Circle Rate x Area. In the case of flats, we take Value = Built-up Area x Construction Cost x Age Multiplier. More checking through the Online Registration System by Delhi.

- Keep in Touch: The circle rates can be updated twice every year. Read up on new updates on official websites thoroughly.

Frequently Asked Question About Circle Rate of Delhi

Q 1: How much is the current circle rate of agricultural land in Delhi?

Agricultural land in Delhi has different circle rates depending on its location, based on other factors such as soil fertility and the distance to urban areas. Market price would be between 2.25 crore per acre to 5 crore per acre, and the government circle rates are less. Get the actual rates in the Delhi Revenue Department site or in localities such as Narela or Alipur.

Q2: Can I purchase a property which costs less than the circle rate in Delhi?

No, it is not legal. Circle rate is the base of the lowest rate of the property registration, and the rate of duty is determined on a circle rate or the cost of the transaction, whichever is higher.

Q3: How much is the existing stamp duty assuming the circle rate in Delhi?

Stamp duty 4 % of women and 6 % for men is computed on the circle rate or the value of the transaction, whichever is higher. In the case of property 50 lakh, it is 2 lakh (women), 3 lakh (men). Check on the Delhi Online registration Information system.

Q4.: What is the difference between the circle rates and market rates in Delhi?

Circle rates are minimum rates set by the government to register property to be used in stamp duty. The prices that sellers of property seek, the market rates, tend to be higher as a result of demand or features. By way of illustration, it is realized that a circle rate of plot in Vasant Vihar is, say, 7,74,000/sq.m; however, its market rate can be higher.

Q5: Does the Delhi government intend to increase circle rates by 30% in the posh areas?

For that, Delhi government raised circle rates by 30 % in some of the posh localities in 2022, with places such as Vasant Vihar and Greater Kailash, and lowered rates in some of the high-rate localities. By June 2025, a review circle rates committee was constituted, and the revision (up to 30 per cent increases in some regions) is yet to be approved. Revenue Department website.

ADD COMMENT